Record changes to your property!

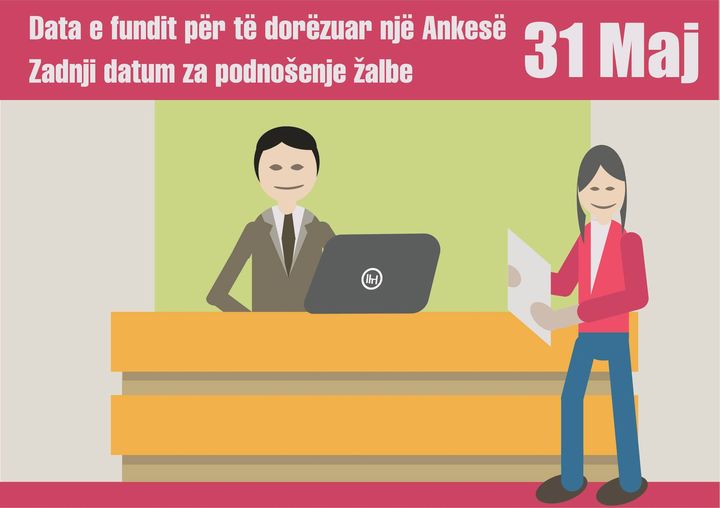

2022-05-10 Pursuant to the Law on Immovable Property Tax (No. 06/L-005, Article 18) on any change in the use of immovable property and/or expansion in immovable property, the taxpayer is obliged to declare that change in the municipality where the immovable property is located within thirty (30) calendar days from the date when the change … Read more